The ResNet family of machine learning algorithms, introduced to the AI world in 2015, pushed AI forward in new ways. However, today’s leading edge classifier networks – such as the Vision Transformer (ViT) family - […]

The ResNet family of machine learning algorithms, introduced to the AI world in 2015, pushed AI forward in new ways. However, today’s leading edge classifier networks – such as the Vision Transformer (ViT) family - […]

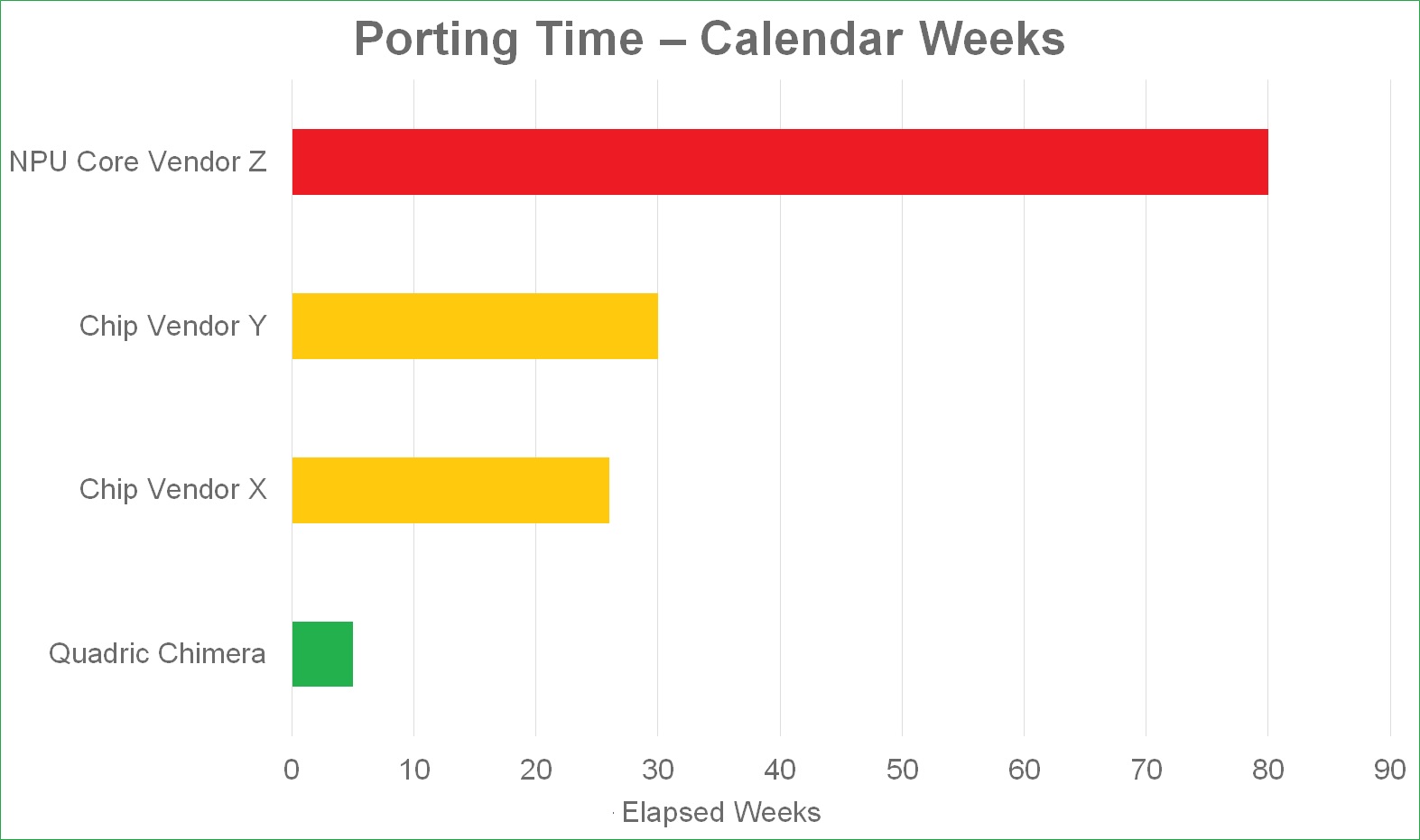

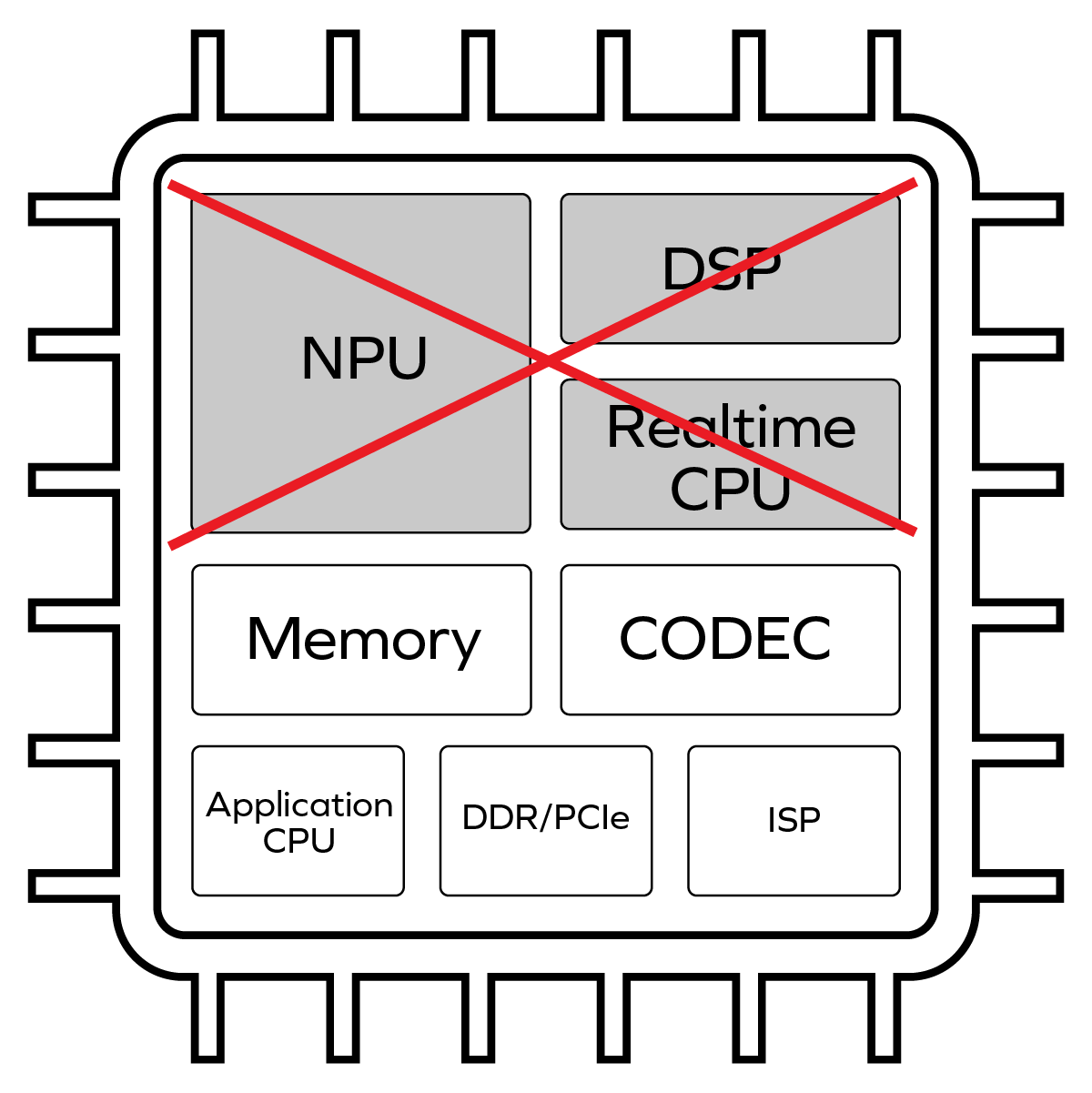

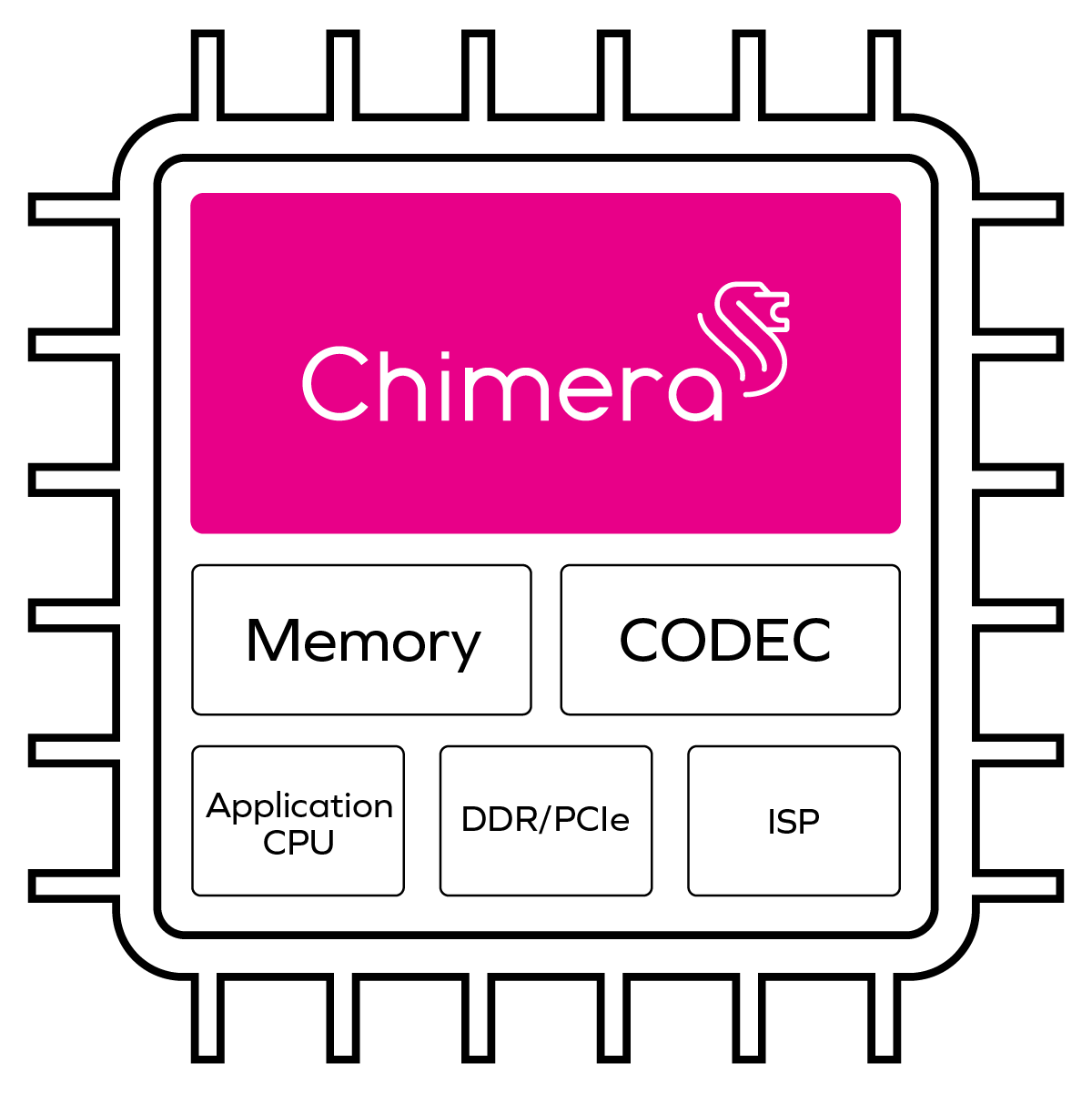

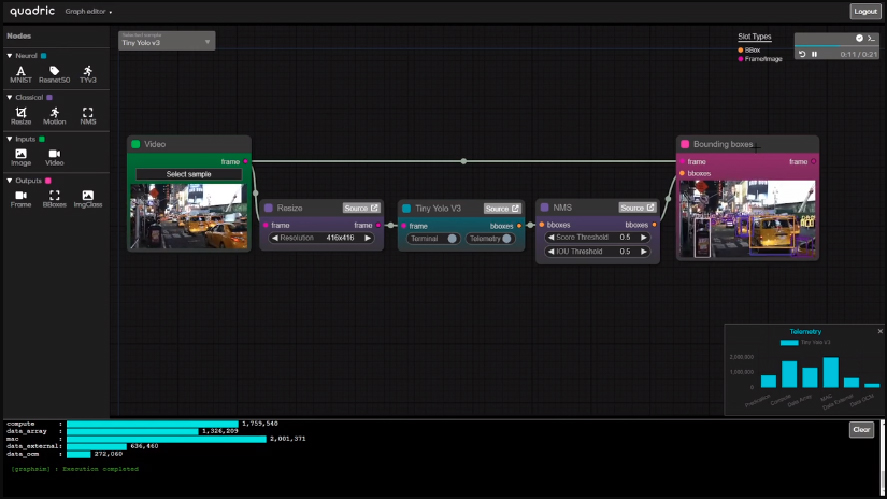

In today’s disaggregated electronics supply chain the (1) application software developer, (2) the ML model developer, (3) the device maker, (4) the SoC design team and (5) the NPU IP vendor often work for as […]

Wait! Didn’t That Era Just Begin? The idea of transformer networks has existed since the seminal publication of the Attention is All You Need paper by Google researchers in June 2017. And while transformers quickly […]

The ResNet family of machine learning algorithms, introduced to the AI world in 2015, pushed AI forward in new ways. However, today’s leading edge classifier networks – such as the Vision Transformer (ViT) family - […]

In today’s disaggregated electronics supply chain the (1) application software developer, (2) the ML model developer, (3) the device maker, (4) the SoC design team and (5) the NPU IP vendor often work for as […]

© Copyright 2024 Quadric All Rights Reserved Privacy Policy